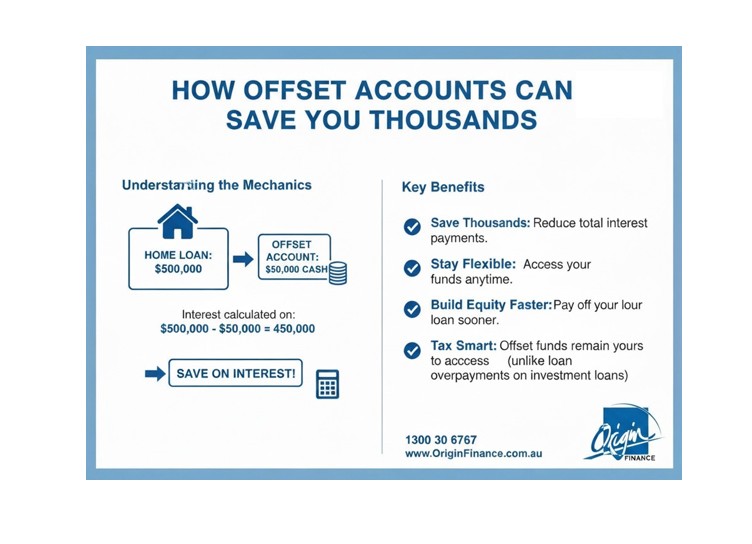

How Offset Accounts Can Save You Thousands on Your Home Loan

If you’re paying off a mortgage, you need to understand offset accounts. They’re one of the most effective ways to reduce the interest you pay and build equity faster.

What’s an offset account?

It’s a savings account linked to your home loan. The balance in this account is “offset” against your loan balance when calculating interest. Simple example: $500,000 loan + $50,000 in offset account = you only pay interest on $450,000.

Why this matters:

- Save Thousands: Even modest amounts in your offset account add up to serious savings over 20-30 years

- Stay Flexible: Unlike making extra loan payments, your money stays accessible when you need it

- Build Equity Faster: The interest you save can go toward paying down your principal quicker

- Tax Smart: Your offset funds remain yours to access, unlike loan overpayments on investment loans

At Origin Finance, we’ve helped thousands of Australians structure their mortgages to maximize offset account benefits. Whether you’re a first-home buyer, investor, or refinancing, we’ll show you exactly how much you could save.

Every home loan is different, and so is every borrower. That’s why we tailor offset account strategies to your unique situation and goals.

Ready to see how much you could save?

Call on 1300 30 6767 to chat with one of our expert brokers or enquire HERE