By Graeme Salt

Inflation figures released today, indicate that we are up for an interest rate rise.

According to the Australian Bureau of Statistics, inflation gained a further 3.8 per cent – economists had been predicting a rise of 3.4 per cent.

As a result, the Reserve Bank of Australia (RBA) is likely to raise interest rates when it meets next week.

What does a rate rise mean for borrowers?

If you have a home loan on a variable rate, chances are your repayments are going to increase.

But let’s get this into perspective. If you have a loan of $500,000 now on 5.25 per cent, a rate rise to 5.5 per cent, will increase your monthly repayments from $2,761 to $2,838.

And, if you have extra money stored in redraw or an offset account, there will be a smaller increase in interest payments.

Many of us now hold more than $100,000 in our offsets and are using them as they are intended – to offset interest. The longer you keep money in offset, the more it reduces your interest payments.

What does a rate rise mean for would-be buyers?

If you have already arranged pre-approval with a bank, you have been sensible as you can have confidence as to how much you can borrow.

Normally this pre-approval lasts 90 days and if you exchange on a property now, your bank will lend you the approved you amount regardless of a rate rise.

But, from now on, you really need to stick close to your broker. A rate rise will reduce your borrowing capacity. So, if you don’t find a property in those 90 days, when you come to extend your pre-approval, chances are the bank will lend you less than previously.

And a few years ago, some banks decided not to honour the pre-approved lending amounts (even during your 90-day period). Your broker will have their ear to the ground as to how each individual bank responds to an RBA rate rise – stay close to them.

But it’s not all bad news for would-be borrowers. While repayments may go up with rate rises, they may also put a brake on house prices. Higher rates will thin out the competition against you when it comes to purchase – many would-be buyers will become more cautious when it comes to buying a place.

What does a rate rise mean for the long-term?

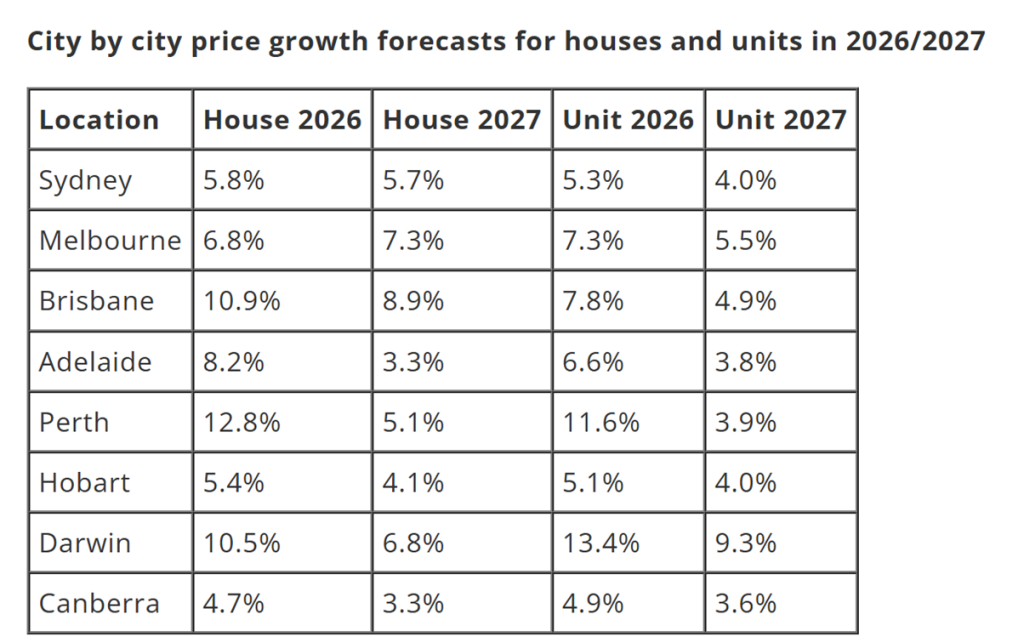

Research released today by KPMG said, “House prices across the country are expected to increase by 7.7 per cent this year, with momentum in the property market expected to continue in 2026, despite ongoing speculation about where rates are heading.”

Interest rates are just one driver of prices (albeit an important driver). KPMG noted that demand for property still exceeds supply – which means that prices are still likely to increase.

Conclusion

An interest rate rise will impact our hip pockets – but let’s get this into perspective.

None of us like having to pay the bank more money. But this is manageable.

And, by holding savings in our offset accounts a future rate rise’s impact won’t be that noticeable.

Graeme Salt is an award-winning mortgage broker. For a no-obligations consultation on your home loan needs, please contact him on 02 9922 5055.