Here’s a simple mortgage strategy that could save you years and tens of thousands of dollars.

We all hear about paying fortnightly, but few people understand how it actually works.

Key Takeaways

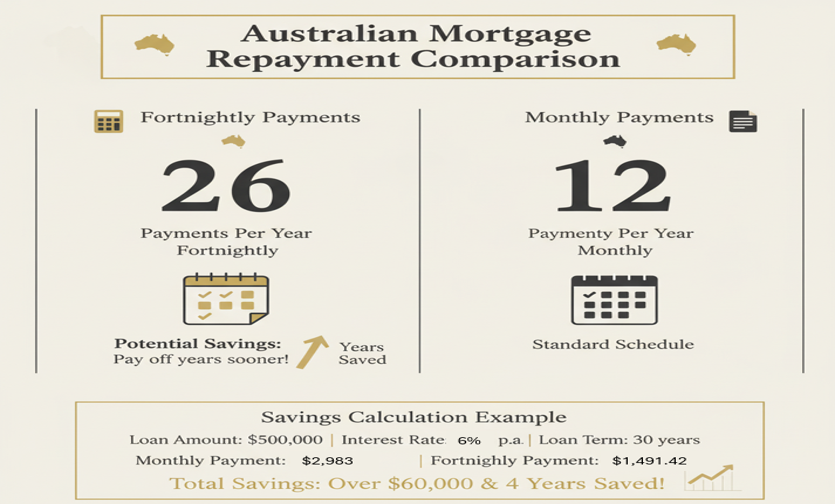

- Paying half your monthly mortgage payment fortnightly can save you years and thousands of dollars.

- This method results in 26 payments a year, effectively making one extra monthly payment without increasing your budget.

- Over a 30-year mortgage, you could save over $100,000 in interest and become mortgage-free years earlier.

- Paying fortnightly reduces the principal faster, leading to less interest over time.

- Consult your broker about this strategy, as banks may not promote it, but brokers can offer valuable advice.

Pay half your monthly mortgage payment fortnightly instead of the full amount monthly.

It sounds small, but the math is powerful. By paying fortnightly, you’re making 26 payments a year instead of 12. That’s one extra full monthly payment annually—without changing your budget significantly.

Over a 30-year mortgage, that single change can shave 4-6 years off your loan and save you substantial interest. On a $500,000 mortgage at 6%, you could save over $122,000 in payments and be mortgage-free years earlier.

Why does this work?

When you pay fortnightly, you’re reducing the principal faster. Less principal means less interest accrues. Compound this over 30 years, and the effect is dramatic.

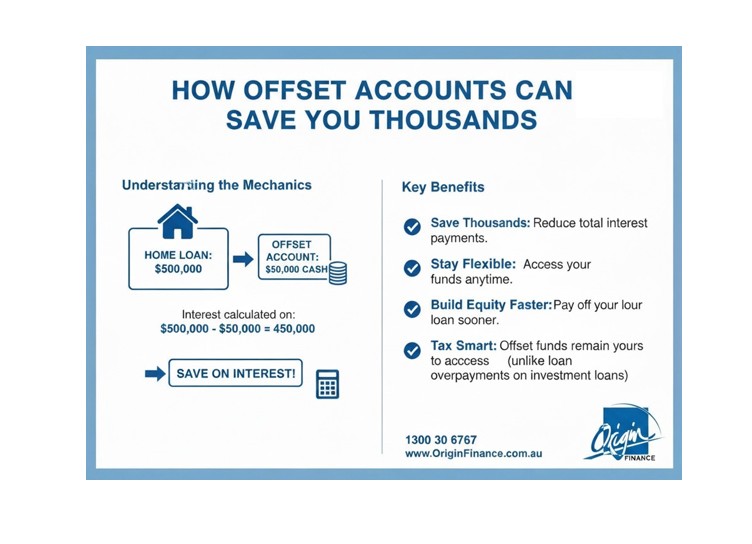

Most Australian homeowners don’t realize this strategy exists. Their bank certainly won’t push it—they make more money the longer your loan runs. But your broker will know this and dozens of other strategies to optimize your position.

If you’re a homeowner or considering a mortgage, this is worth a conversation with your broker. Small changes in payment strategy can have massive long-term impact.

If you would like to assess your personal situation call Origin on 1300 30 6767 or Enquire Here

MortgageStrategy #AustralianMortgage #HomeLoan #FinancialPlanning #MortgageBroker #PropertyInvesting #DebtReduction #WealthBuilding