Home Loans

Being a first time buyer, the staggering number of home loans available can be overwhelming. At Origin Finance, we put you first. We will help you to understand the types of loans available and choose the structure that will enable you to achieve your home ownership goals.

Choosing the home loan that’s right for you

Origin Finance makes it easier to buy your first home sooner, with our flexible home loan products. You can borrow up to 95% of the property value. We help to ensure you can afford the repayments and have funds to cover the transaction costs. We’ll even help you with your First Home Owner Grant application!

First home buyers often want to know when the best time to buy is going to be. The answer is simple when you have a professional home loans lender. There is no right or wrong time to buy your first home – only the time that suits you and your circumstances.

Many would-be investors will try to time the market and buy at the bottom of the real estate cycle, looking for a bargain, but the truth is it makes no difference when you buy. The right time is when you feel you’re ready to go out and buy your own home.

How Our Brokers Can Help

Basic Home Loan

Introductory Rate

Redraw Facility

Line of Credit

All-In-One Accounts

100% Offset Account

Split Loans

Buying a Farm

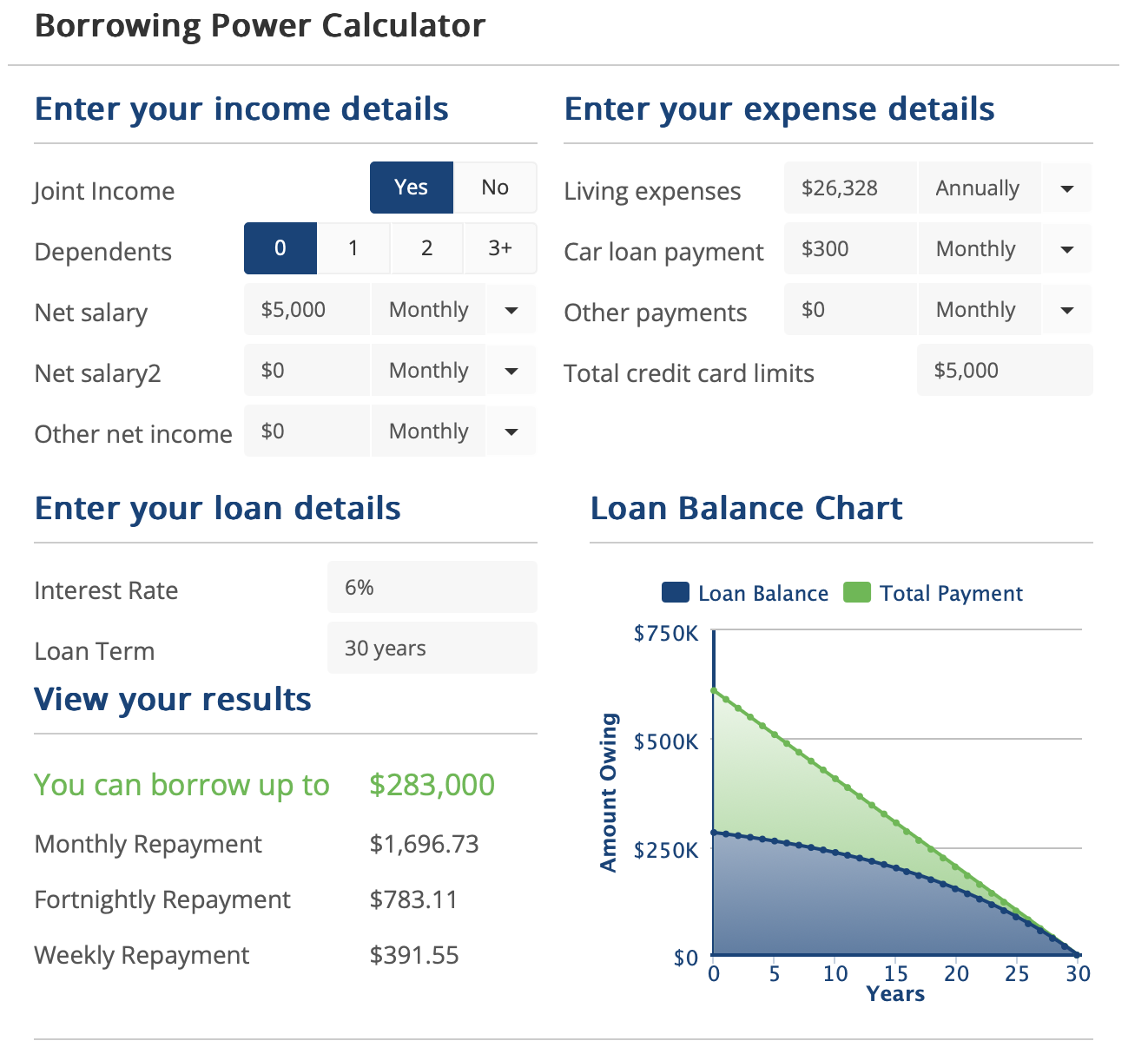

How much can I borrow?

Before you go hunting for your new home, you should have a clear idea of exactly how much the banks will allow you to borrow. Once you understand how much borrowing power you have, learn how much the repayments will be and work out if this amount is affordable for your income level.

Knowing your borrowing capacity and your repayments ahead of time means you won’t be tempted to overspend or go hunting for houses that are outside your budget. Contact, our home loan brokers they may be able to help you achieve your goals.

Calculators

Mortgage calculators can remove much of the guess-work of applying for a mortgage. Playing around with your numbers on our calculators will help you gain an idea of how much you could borrow.

This is a great starting point while you’re researching your home loan options.

Qualifying for your first mortgage

Purchasing your first home can be a very rewarding experience. Everyone looks forward to owning their own home at some point in their lives, and doing so requires that you that you are prepared and qualified.

Navigating the home buying process can be mind boggling, which is where your mortgage broker’s help comes into play. Your mortgage broker should be able to field your questions and to help

First Home Owner Grant

The First Home Owner Grant (FHOG) is a national scheme set up to encourage and assist home ownership. Benefits vary from state to state and your Origin Mortgage Broker will help you to understand what you can qualify for and lodge the application on your behalf to ensure you achieve maximum benefit.

In NSW, the First Home Owner Grant (New Homes) scheme was established to assist eligible first home owners to purchase a new home or build their home by offering a $10,000 grant.

Find the right broker

Meet our diverse team of expert mortgage brokers, based across Australia and fluent in a range of languages and specialties — so you can find the right broker for your needs, no matter your background or goals

FAQ

Why should I use a mortgage broker instead of going directly to a bank?

A broker compares loans from multiple lenders — not just one — and helps you find the most suitable option for your budget and long-term goals. They also guide you through the paperwork and approval process.

What’s the difference between a fixed and variable rate loan?

A fixed-rate loan gives you predictable repayments for a set period, while a variable rate loan can fluctuate with the market — which means your repayments might go up or down. Many first-home buyers choose a mix of both.

How do I know how much I can borrow?

Your borrowing power depends on your income, expenses, debts, and the size of your deposit. Our calculators can give you a ballpark figure — but for a full assessment, speak with a broker.

Ready to apply?

It’s vitally important you speak with a specialist mortgage broker with experience in commercial lending before you apply for anything. If you’d like to make an appointment for a no obligation consultation for your commercial project, call one of the specialist Commercial Mortgage consultants at Origin Finance today to discuss your needs.