By Graeme Salt

Prices for first home-buyer properties are about to take off due to recent announcements from the federal government.

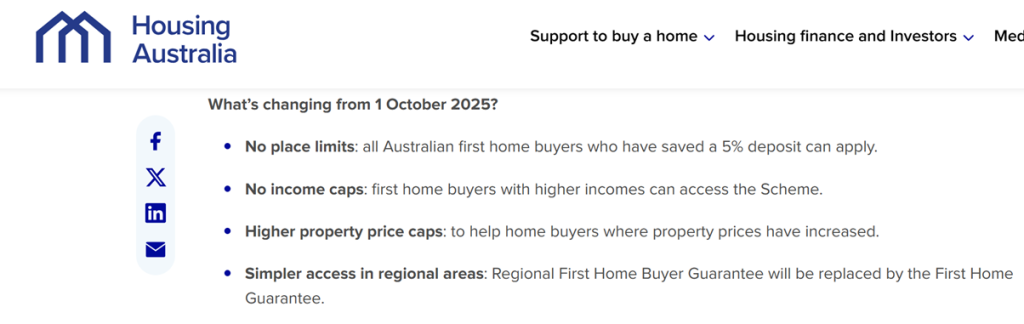

Following of the from its election commitment, the Labor Party has announced an expansion of the first home buyers’ scheme – beginning this October.

These changes see an expansion of the scheme and the removal of place limits on the scheme.

Before these changes, some first home buyers found that

- Banks had allocated all their spots under the scheme; or

- That the price caps made the scheme unworkable in our major cities

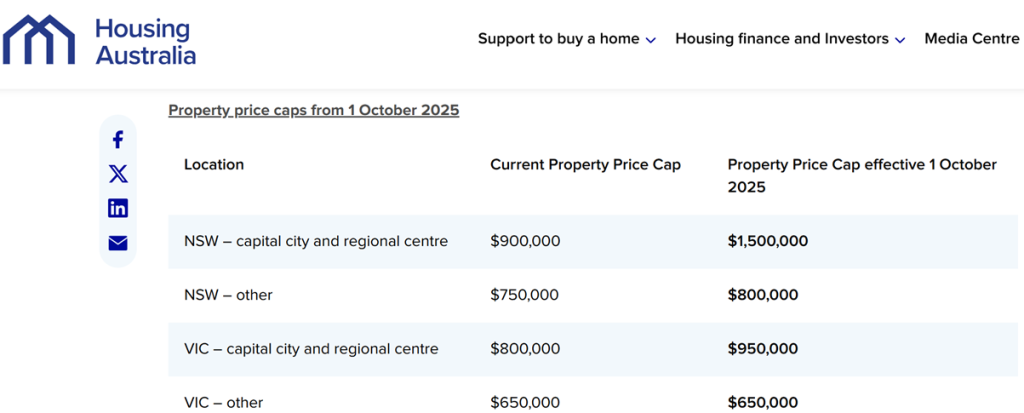

Now, with Sydney price caps raised to $1.5m, the scheme is now relevant to many who want to buy in the Harbour City.

In the decades I have been mortgage broking, there has been one consistent consequence of these first homeowner schemes – prices have shot up.

These changes come on the back of a rate cut which will spur on the wider property market. But, where property will really take off in the more affordable first home buyer segment.

And we are particularly likely to see a rocket up property prices in the $800k-$1.5m mark.

So, if you are thinking about buying your first home, I would suggest you get serious NOW. Come October, you will have heaps of competition out there!

There’s nothing more frustrating than paying $50k more for a property in January than if you bought it today!

Graeme Salt is an award-winning mortgage broker. For a no obligations on your home loan needs, please contact him on 02 9922 5055