By Graeme Salt

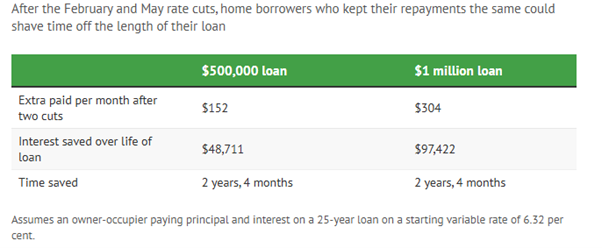

The next move for rates is down and home-owners could shave over two years off a 25-year-mortgage if they keep their repayments the same as before the February and May interest rate cuts.

Increasingly, Aussies are saving rather than spending extra cash with CBA figures this week showing only 10 per cent of eligible home-owners chose to cut their direct debit payment after the May cut in interest rates. A similar trend followed the February cut.

National Australia Bank also says more than 90 per cent of borrowers kept repayments on hold.

By maintaining home loan payments at previous higher rates, homeowners can save tens of thousands of dollars in interest over the term of their loan, ranging from $48,711 on a $500,000 mortgage to $97,422 on a $1 million loan, comparison platform Canstar found:

It’s the same with recent tax cuts – which have delivered, on average, a $220 boost in post-tax income to people through July and yet many have chosen to save rather than spend the cash.

Graeme Salt is an award-winning mortgage broker. For a no-obligations consultation on your lending needs, please contact him on 02 9922 5055