By Graeme Salt

What if there are no more mortgage interest rates to come?

Underlying inflation increased to three per cent in the year to September, which was well above economists’ expectations of 2.7 per cent.

As a result, the Reserve Bank of Australia (RBA) kept interest rates on hold this month at 3.6 per cent.

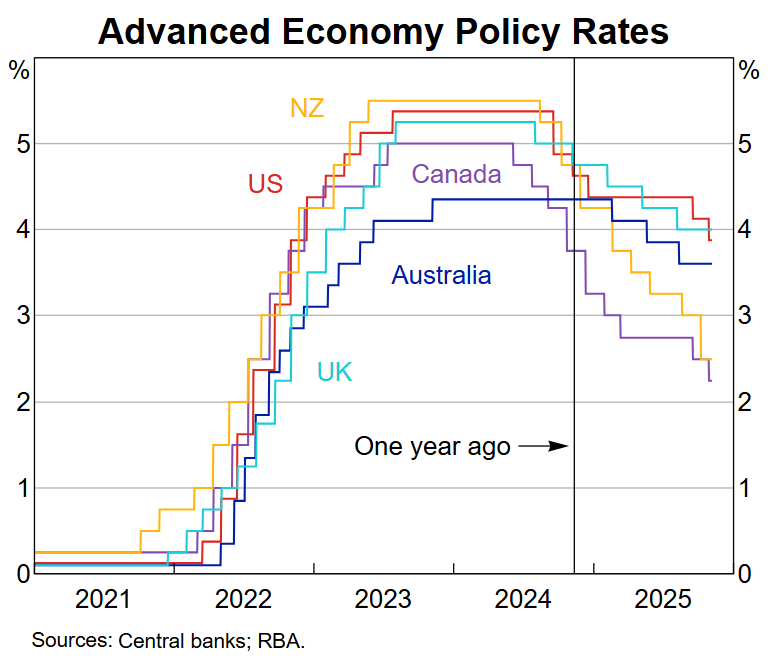

Some economists are now stating that there may be no more rate cuts to come. And, as the RBA has pointed out – to tame inflation, we didn’t have to get interest rates as high as other countries and so, we probably don’t now need to come down too much either.

Increasingly, clients are asking me if they should fix the interest rates on their mortgages.

Certainly there are some tempting rates out there; a 4.89 per cent fixed loan is about two rate cuts sharper than the prevailing variable rates.

But as RBA Deputy Governor, Andrew Hauser, said yesterday “I don’t think you have to be mad, or a fanatic, to think that future rate cuts could be coming.”

One of the downsides of fixed rates is just that – they are fixed. And, if variable rates drop below fixed, it will cost you an arm-and-a-leg to break the loan.

Many of my clients are looking to hedge their bets by fixing part of their loans. Part fixed, part variable is seen as a good two-way bet.

The other way they are making their money work for them is by optimising their offset accounts. Let’s face it, if your loan is fully offset, you are paying zero interest regardless of what the rate is!

For would-be purchasers, a rate pause is probably a good thing as it will probably calm down some of the animal spirits we are seeing in the property market right now – meaning that, if you can afford these higher rates, you may well be in a better position than chasing rocketing house prices.

Our hip pocket may want rate cuts. But a pause may not be the end of the World.

Graeme Salt is an award-winning mortgage broker. For a no-obligations consultation on your lending needs, please contact him on 02 9922 5055