By Graeme Salt

New analysis from Cotality reveals that families are paying up to $1.3 million more for houses inside sought-after public school catchments in Sydney and Melbourne – but that does not always equate to stronger capital growth.

In many of our larger cities, parents choose to live within the catchments of good public schools to avoid paying private school fees. This can often drive-up fees in these good school zones.

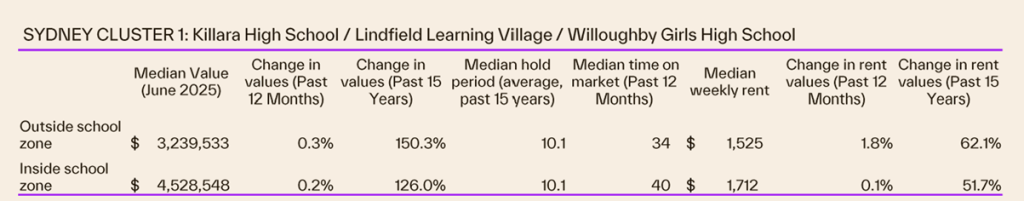

The largest price gap was seen in Sydney’s leafy North Shore, where homes in the combined catchments of Killara High, Willoughby Girls and Lindfield Learning Village held a median value nearly $1.3 million (or 39.8 per cent) above homes nearby but outside the catchment.

In Melbourne, the premium for homes in the catchments of Princes Hill and University High School reached $357,000.

Despite this, houses in this Sydney catchment recorded lower long-term growth of 126.0 per cent over the past 15 years, compared to 150.3 per cent in neighbouring markets. Similar disappointing growth also applied to Melbourne catchments too, with 82.6 per cent within school zones but 106.1 per cent beyond the boundaries.

Source: Cotality

Are you really saving money?

According to Futurity Invest, the average cost of 13 years of private education in Australia was estimated at $349,000 in 2022, with significantly higher costs reported in Sydney and Melbourne. Some leading Sydney private schools charge upwards of $46,000 annually, placing the cost of secondary education alone at around $276,000 per child.

But, if you are paying $1.3m more for a home, maybe it’s just worth paying the school fees?

Here things can get more complicated; school fees have tended to rise over time, whereas mortgage repayments often decrease in real terms due to inflation. This makes a one-off investment in location potentially more cost-effective than recurring tuition.

What do you really want?

Most parents presumably buy a home within a school zone in the interests of their kid’s education. And, while their logic is understandable, they may or may not save money by avoiding paying school fees if they have to pay much higher housing costs.

But, for investors, this research implies that school zones are not good investments. Presumably the capital growth here occurred once properties were included in a zone and parents got wind of the quality education being delivered.

Maybe now, these school zones are so expensive that investors would make more money beyond their confines?

If you want to talk with me more about your investment plans, please feel free to get in touch

Graeme Salt is an award-winning mortgage broker. For a no-obligations consultation on your home loan needs, please contact him on 02 9922 5055.