By Graeme Salt

While this month’s rate cut has arguably stirred the property market, it may not create a property market frenzy of old.

This may be good news for would-be home buyers.

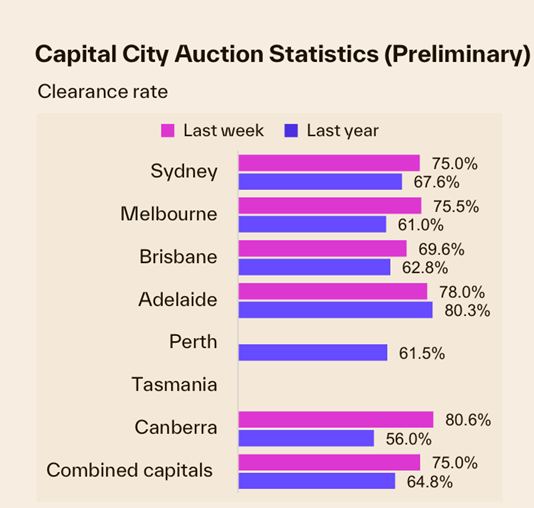

The market has certainly responded positively to the August rate cut, with the combined capital’s preliminary auction clearance rate rising to 75.0 per cent, 3.3 per centage points higher than the previous week.

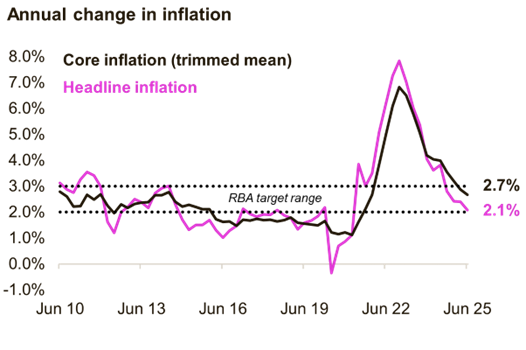

However, some economists have noted that even if interest rates decrease by another 50 basis points to 3.1 per cent, the cash rate would only be around neutral territory. Prior to the pandemic, the decade average cash rate was just 2.55%.

For many, affordability is still a major stretch.

Futures market pricing puts the cash rate at 3.2 per cent by year’s end and 3.1 per cent by March next year implying we could see one or two more rate cuts over the next seven months.

It would be amazing for would-be home buyers price did not go so crazy that they did not get disheartened.

Graeme Salt is an award-winning mortgage broker. For a no-obligations consultation, please contact him on 02 9922 5055