By Graeme Salt

Australians have coped with 4.25 per cent rate rises between 2022 and 2024 – which may indicate resilience of the household budget, the economy and the property market.

Much of this is due to buffers built up during the pandemic according to new research.

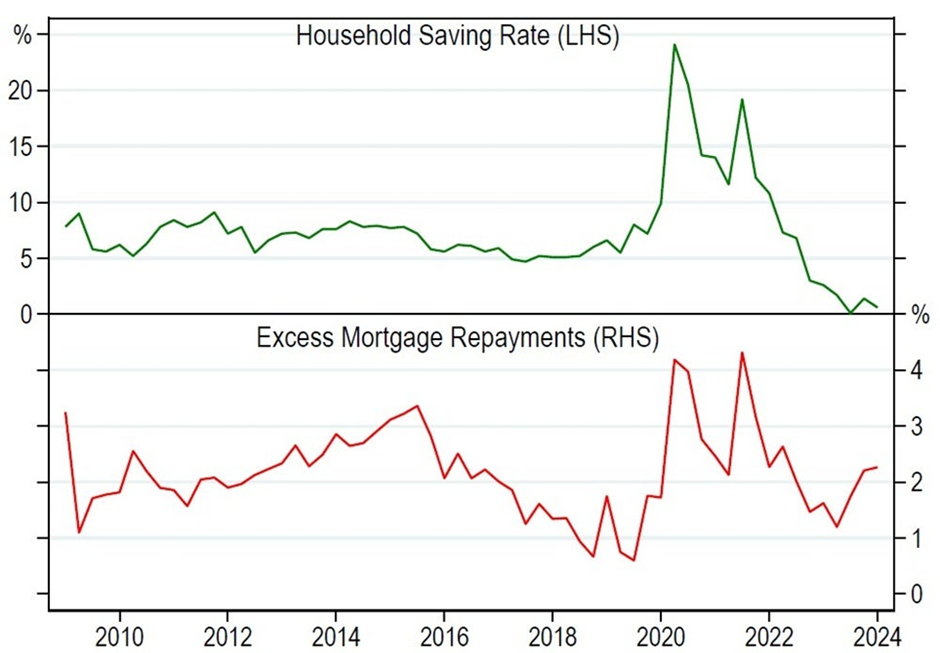

During 2020-2021, household savings shot up to around 20 per cent – providing substantial buffers for mortgage holders to draw upon when interest rates began rising.

And, when interest rates started to increase, many Australians were able to meet their repayments thanks to their excess funds either paid into redraw or into their offset account.

The analysis showed that 70 per cent of the increase in mortgage repayments was paid for by individual’s drawing down on their savings and 26 per cent by individuals bringing in funds from external sources. Over this period, variable-mortgagors experienced a $13,884 increase in mortgage repayments relative to fixed-rate mortgagors and yet, they were able to keep spending

Now that the trajectory for interest rates is for them to come down, the question is-where will those excess funds now go?

The research (The Mortgage Debt Channel of Monetary Policy When Mortgages are Liquid) was produced by UNSW, the University of Sydney, the e61 Institute and the University of Chicago.

Graeme Salt is an award-winning mortgage broker. For a no-obligations consultation on your home loan needs, please contact him on 02 9922 5055.