2025 property will be ‘game of two halves’

By Graeme Salt

The first half of this year presents opportunities for those looking to get on the property market. But when the whistle blows, on key decisions in the second half, prices are likely to go up again.

Buyers with the means to purchase will be able to take advantage of an ongoing slowdown in the market next year, with the runaway price growth seen across much of the country over the past year finally easing.

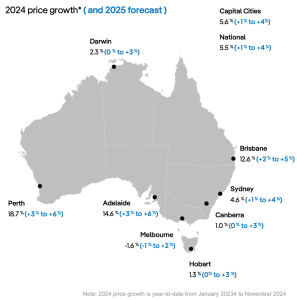

Some prices are forecast to rise by between one and four per cent at the national level, according to PropTrack.

That modest growth is slower than the 5.5 per cent growth recorded so far this year, with the high number of homes on the market and affordability constraints keeping prices in check.

However, much of these savings may well occur in the first half of the year, with price rises in the second half spurred on by policy changes.

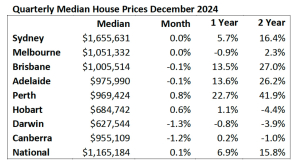

Our two biggest markets, Sydney and Melbourne, ended 2024 with a whimper. In fact, most capital cities have been seeing new listing volumes trending higher throughout 2024 as seller willingness to put properties up for sale has increased – this has made the market more pessimistic.

But the first key change that could spur the market is forthcoming interest rate cuts – once the whistle is blown announcing rate cuts, things could change.

The Reserve Bank of Australia has left interest rates at 4.35 per cent for more than a year. But many economists are predicting two or three cuts this year. ANZ and NAB are both tipping the first cut in May; a second in July is likely too.

But also, we are due a federal election in May. As we enter early 2025, we face a period of uncertainty as we wonder if there will be any major changes in Canberra. Once the electoral dust has settled, Australians will have more confidence in the market and the economy.

The Australian property market has a good run; strong immigration has driven supply while construction costs have limited supply. We are likely to more of this – though more likely in the second half of 2025.

Early 2025 will present buying opportunities – will you be on the field or sit on the sidelines?

Graeme Salt is an award-winning mortgage broker. For a no-obligations consultation on your lending needs, please contact him on 02 9922 505

Origin Finance is a

Origin Finance is a

Leave a Reply

Want to join the discussion?Feel free to contribute!