Helping you make confident, informed choices

At Origin Finance, we believe the right loan can open doors — to your first home, your next investment, or simply more peace of mind.

We’re one of Australia’s most trusted mortgage brokers, giving you access to a broad network of lenders — from major banks to specialist providers you won’t find on your own.

That means more choice, more flexibility, and more ways to tailor your loan to suit your real-life circumstances. Whether your situation is straightforward or complex, we’ll help you explore the right options and feel confident in your next move.

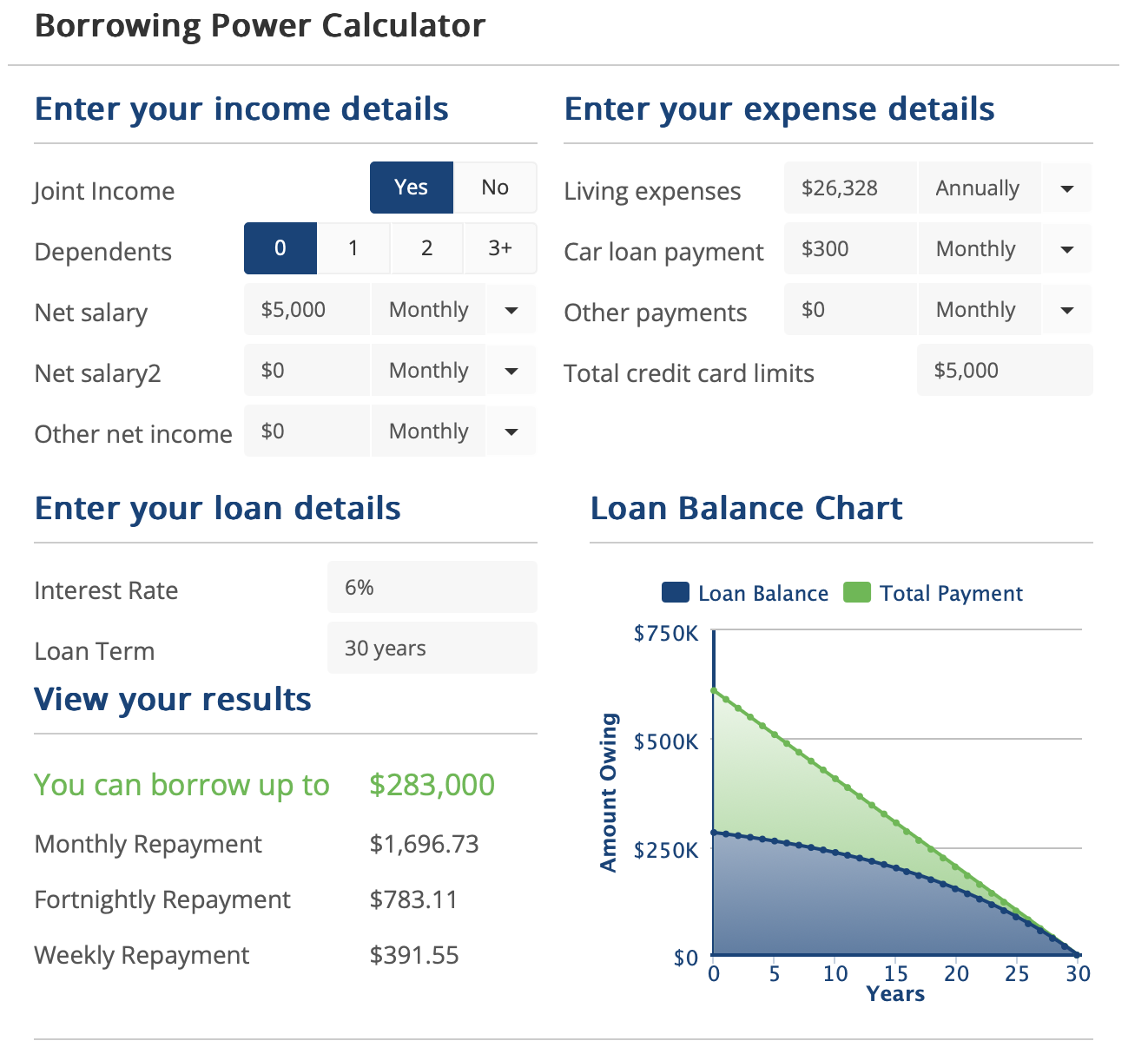

How Much Can I Borrow?

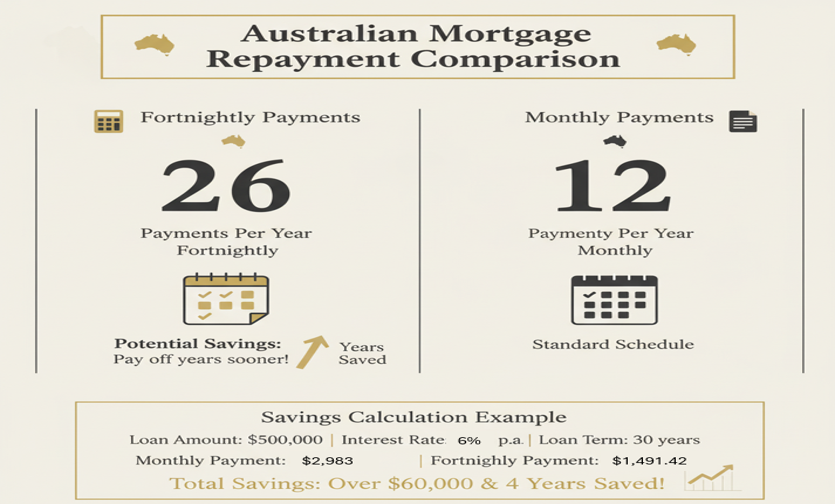

Mortgage calculators can remove much of the guess-work of applying for a mortgage. Playing around with your numbers on our calculators will help you gain an idea of how much you could borrow.This is a great starting point while you’re researching your home loan options.

Why work with a mortgage broker?

Because more choice means better outcomes — for you.

Unlike banks, we’re not tied to a single lender. That means we can look across a wide panel of providers to find the loan that actually fits you — your goals, your circumstances, your future.

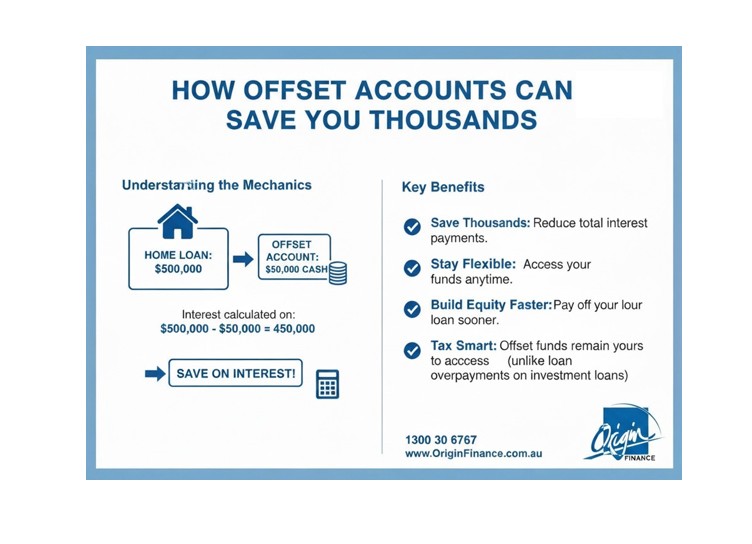

At Origin Finance, our brokers compare interest rates, loan structures, features, and flexibility across the market — from major banks to specialist lenders you might not even know existed. Whether you’re buying your first home, refinancing, or investing, we’ll help you make a smarter choice with expert advice and real support at every step.

We know that great advice starts with understanding.

That’s why our team includes brokers from all walks of life, fluent in multiple languages and experienced across a range of loan types — so we can pair you with someone who truly gets you.

The Origin Guide to finding a Better Interest Rate

Your current home loan might have been a great deal when you first got it, but banks are competitive, rates change and lending products evolve. Your home loan simply might not be working as hard for you as it could be. Even worse, your home loan could be costing you money.

Perhaps it’s time to consider a mortgage check-up to see if yours is the best home loan to suit your situation.

Take The First Step - Contact Us Today

Once you’re ready to move forward, your dedicated mortgage broker will guide you through the entire process — from application to approval to settlement.

And it doesn’t stop there. We’ll be here long after your loan is in place, ready to help with any questions, future finance needs, or changes to your goals along the way.