A lending clampdown is coming but no-one knows when!

Author: Graeme Salt

It’s going to get harder to get a mortgage – but not that much harder and not immediately!

That was the conclusion of three speeches from bankers this week.

But eventually, it will become tougher to get a loan.

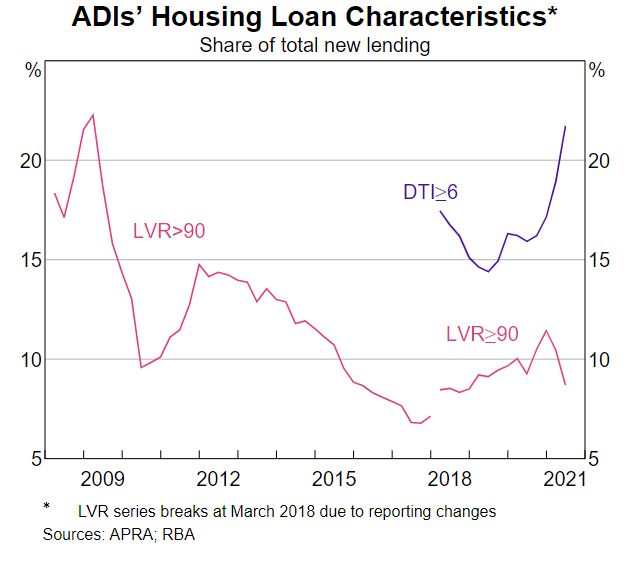

The first speech warning us that changes could be afoot came from Michele Bullock, Assistant Governor of the Reserve Bank of Australia. In her speech, Ms Bullock noted that Australians’ debt levels were high, with more of us than ever having debt levels six times salary levels (see chart below).

At the same time, she noted that “lending standards overall have been maintained in the face of very strong demand for housing.” Certainly I can echo this with the loans I arrange – the banks make people jump through hoops to get a loan.

Housing credit is growing at an annualised rate of 7 per cent and could reach 11 per cent by early next year.

And economists are now concerned that too much risk-taking in the property market could pose a risk to the financial system. Ms Bullock said, “with the increase in housing prices and housing debt, risks to financial stability could be building”.

“When prices are rising very rapidly and there are expectations that this will continue, borrowers are more likely to overstretch their financial capacity in order to purchase property. We are therefore watching developments in housing markets and credit very closely.”

How can the regulator limit lending?

In the past, the banking regulator APRA has targeted speculative investors through limiting interest only loans and mortgages with high loan-value-ratios.

This time, the risk is more of household budgets being stretched – so, if the handbrake is applied to the market, it’s more likely to be to limit those with high debt levels (often first home buyers).

Two bank bosses, Shayne Elliott of ANZ and Matt Comyn of CBA, are now so concerned about overstretched household budgets that they called on the regulator to start imposing lending restrictions.

But if the banks are so concerned about the risk to the economy of over-extended borrowers, why aren’t they limiting lending themselves? Because they are not that concerned!

The banks know that, at some point, the screw will be turned to limit borrowing – but just not yet. So, the banks will keep looking for business and lending money.

No bank will deliberately turn away good business by stopping lending while the rest continue to do so.

And as the banks know lending remains a safe bet, they will keep the money taps turned on.

But one day, the regulator will say enough-is-enough. It’s just a question of when and by how much.

Graeme Salt is a leader of The Futurus Group whose brands primarily comprise, Origin Finance, Chan & Naylor Finance as well as Walker & Miller Training. For a no-obligations consultation, please contact him on 1300 30 67 67.

Origin Finance is a

Origin Finance is a

Leave a Reply

Want to join the discussion?Feel free to contribute!