The Bond Market Says Your Home Loan Rates Will Fall

Normally if you are going to lock your money away for a period of time you would expect to get a higher return. Same as if you are looking for a fixed rate home loan, the longer the time frame the higher the rates should be as an offset of time and risk. The bond market is the same, long term rates should be much higher than short term rates to take into account the same dynamics.

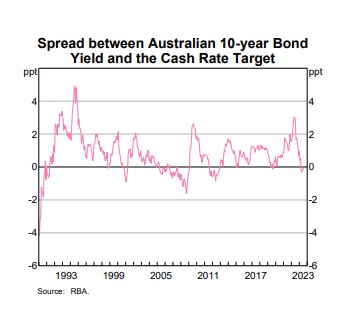

Currently 1 to 10 year bond rates are below or at the Target Cash rate set by the Reserve Bank of Australia. The cash rate is 4.10% while the 5 year bond rate is 3.875% . Normally it should be between 0.25 and 0.75% above the rate depending on the market outlook and is actually currently 0.225% below the RBA’s target cash rate. Like wise all the medium term rates are below the target cash rate set by the RBA, for example the 1 year rate is 3.97% , 0.013% below it while the difference between 10 Year Bond rate and cash rate has dropped to zero.

This normally means that the market expects to see interest rates drop. A little in the next year and possibly more in 2 to 10 years.

What does this mean for you as a home owner or potential owner? It means that home loan interest rates could possibly have peaked and some relief is on the way. It can also mean increased activity and prices as historically when interest rates fall, property prices increase. This is to some extent why we have seen the increase this year in prices in metro centres as buyer are trying to “get in” before the price rise happens which has been exacerbated also by a lack of supply, especially in new home construction.

If you want to avoid the stampede that happens as rates go down, now may be a good time to think about getting your finances in order and planning your next real estate move, whether it’s your first home , an upgrade or another investment property .

For a free assessment with your Origin Finance broker call 1300 30 67 67 or fill in the enquiry form on this page.

Origin Finance

Origin Finance

Origin Finance is a

Origin Finance is a Origin Finance

Origin Finance Origin Finance

Origin Finance

Leave a Reply

Want to join the discussion?Feel free to contribute!