What first home buyers can do to get on the property ladder

By Graeme Salt

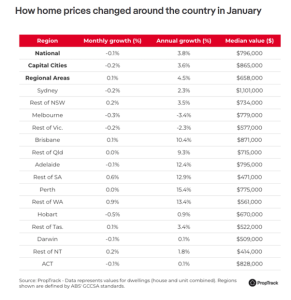

Property in Australia is expensive. Property in our capital cities is really expensive. Property in Sydney is really, really expensive. So, what can you do to get on the property ladder?

For many, the issue is less about income and more about savings; they may have the income to justify a loan, but the cost-of-living means they are struggling to build up the savings for a meaningful deposit.

Many banks understand how tough it is for first-time buyers and have initiatives to help first-time buyers. Here are some examples.

- Get a Gift

According to one survey, more than 60 per cent of first-time buyers receive some form of financial assistance from their parents to buy their first home.

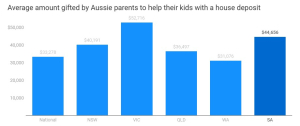

The ‘Bank of Mum and Dad’ is estimated to be worth about $35 billion. With Victorian kids receiving the largest gift from their parents – over $50,000.

While banks like to see that someone has saved up their deposit, they know it can be tough. Most will accept a Statutory Declaration from parents – others even have a dedicated form for parents and borrowers.

- Get a Parental Guarantee

If buyers have less than a 20 per cent deposit for their home, they often have to fork out for Lenders Mortgage Insurance. In itself, it can be costly – plus, it attracts higher interest rates.

One way around this is to secure the loan also against a parent’s property. This way, the family equity contribution is way more than 20 per cent and as a result, interest rates are lower.

Not every bank accepts a parental guarantee; talk to your broker as to which bank will do it.

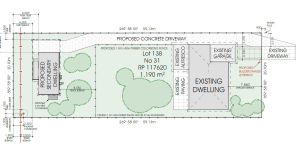

- Buy with a mate

ING & CBA have special loan products where people can buy a home with a mate – but retain their own financial independence. This can help friends pool resources together – so they have enough deposit.

- Get help from the Government

Both state and federal governments have special schemes designed to help first-home buyers get on the property ladder

- 35,000 places have been made available under the federal government’s First Home Guarantee Scheme to help those bridge the gap when they only have a five per cent deposit

- Many state governments will waive the need for first home buyers to pay stamp duty (in itself about 4 per cent of the property’s purchase price)

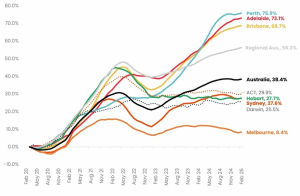

- Try Rentvesting

Sometimes we just can’t afford to buy where we want to live, but want to get into property. One option is to buy an investment property in a cheaper location, rent it out then live where you want to live.

I am currently financing a Townsville purchase for a Sydney woman. The plan is that, in time, it will help her build up enough equity for a Sydney purchase in future.

It’s tough for would-be first-home buyers. Thankfully lenders recognise this and will help where they can. If you want to learn more about options for would be first-time buyers, please feel to get in touch.

Graeme Salt is an award-winning mortgage broker. For a no obligations consultation on your home loan needs, please feel free to contact him on 02 9922 5055

Origin Finance is a

Origin Finance is a