Graeme’s investment experience #3

By Graeme Salt

This week my new tenant moves into my new granny flat.

Building a granny flat has been a key part of my wealth creation strategy as it allows me to create further equity in my assets.

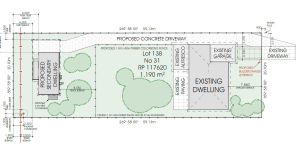

The background to this is that I bought an investment property in Brisbane about 18 months ago that was large enough for me to build a granny flat, almost as a battle-axe development.

It cost me just shy of $235,000 to build the granny flat and the tenant will pay me $400 a week, which works out almost as a nine per cent gross rental yield.

I am particularly happy with the tenant. She is a paramedic who has been employed by QLD Health for over 10 years and has an excellent tenancy history.

For me, income is an important consideration. But I still need to factor in capital growth; I am of that age where there’s much I want to do and still have a healthy risk appetite.

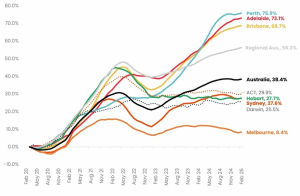

With more luck than good judgement, I have already done well out of the initial purchase as the Brisbane property market has had a heck of a growth spurt over the past few years. Hopefully, with the Olympic Games coming, there will still be a stimulus to the region for the next few years.

But I also think I can create more equity in the property. When I bought, I consciously did not buy the best house in the street as I saw the property’s potential. Working with the existing tenant and agent, I have been able to give the property a bit of Tender Loving Care which hopefully has increased its value.

Once this has all bedded down, my plan is to tap into the equity I have created and use it as a deposit for another property.

Message me in a year to see if I made the right choices.

None of this is financial advice – your financials circumstances may be very different to mine, but feel free to message me about how to finance an investment purchase.

Graeme Salt is an award-winning mortgage broker. For a no-obligations consultation on your lending needs, please contact him on 02 9922 5055.

Origin Finance is a

Origin Finance is a