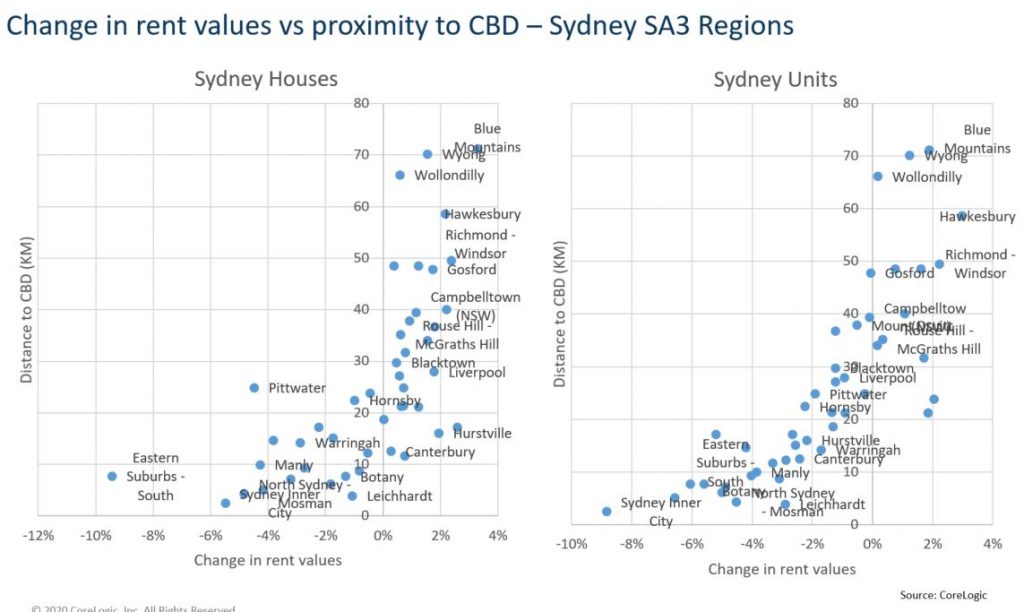

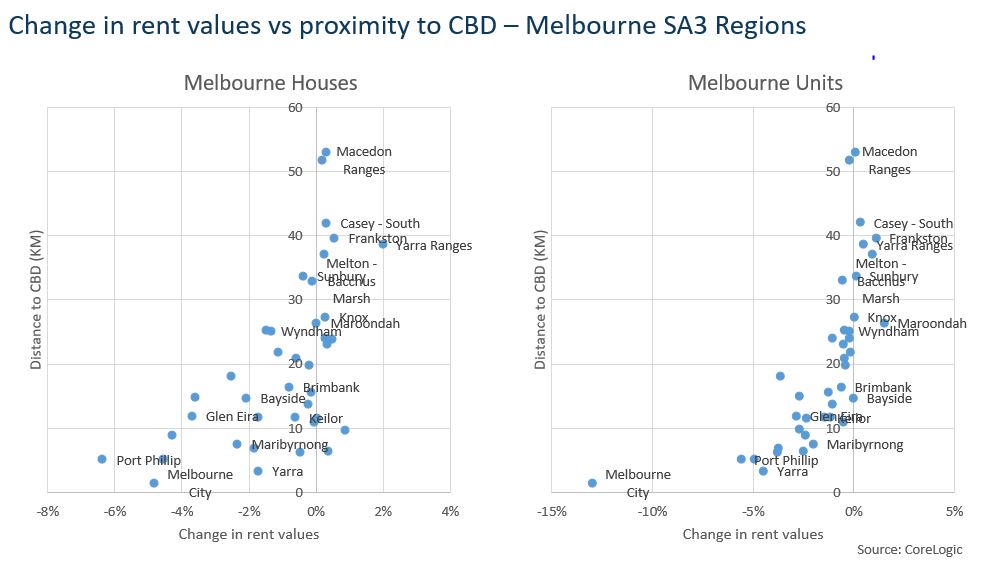

Closer to the city? Prices down. The Burbs & beyond? Prices up

A two-speed market is developing for both rentals and owner-occupied properties

Research from Corelogic showed that rents have fallen by as much as 10 per cent in certain inner locations since the onset of Covid-19, but that locations some distance from the CBD have enjoyed rental growth.

With poor rental returns, it’s difficult to see investors making a bee-line for more central locations – and as we have learnt how to work from home, many owner-occupiers are choosing to purchase in outer locations that ostensibly offer superior lifestyles.

Many of these inner locations have seen rents come down as their population often had a high exposure to overseas migrants; with Australia’s international borders closed for some time, the tap has been turned off for potential tenants.

In addition, many of these locations, such as Melbourne’s Docklands (where unit rents have fallen by around 13 per cent) or Sydney’s eastern suburbs (where houses now rent for nine per cent less), often have high levels of residents employed in the hospitality sector.

Across the country, the highest housing rental value increases were in the Blue Mountains – rising by 3.3 per cent.

These rent changes are also comparable where owner-occupiers are looking to buy; the recent adoption of technologies such as Zoom, seem to have compressed distances. Where once we baulked at commuting distances of say, 70km every day, we are far more comfortable if we work from home four days and only commute to the office once a week.

Your Origin broker often sees what changes are occurring in the property market – feel free to call him/her for their perspective on recent trends.

Origin Finance is a

Origin Finance is a

Leave a Reply

Want to join the discussion?Feel free to contribute!