Property Market Lift Off

By Graeme Salt

And just like that, the property market is on the way up.

And just like that, the property market is on the way up.

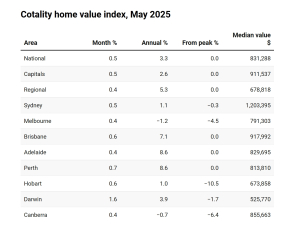

Cotality’s Home Value Index for May showed dwelling values have jumped 1.7 per cent over the first five months of the year. Values in every capital city rose in May, by at least 0.4 per cent.

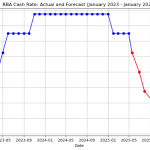

Another two rate cuts are expected over the course of the year by most of the major banks, and the influence on the market is likely to be higher values and higher sales activity.

The next Reserve Bank meeting is in July, and with this week’s GDP figures showing the economy is only growing at 1.3 per cent, another rate cut next month is all but locked in.

Experts at Origin Finance previously predicted that the second half of 2025 would see growth in the property market and this is now starting to happen.

What we are starting to see now is potential buyers experiencing Fear of Missing Out (FOMO), with many rushing to get into the property market before it’s too late. In Sydney days on market has now fallen from 66 in March to 63 in April, according to the latest Domain data.

Now is the time to get your pre-approvals in place with the banks. If you want to understand how to arrange a pre-approval and how this can get you not the property market, please message me.

Graeme Salt is an award-winning mortgage broker. For a no-obligations consultation on your home loan needs, please contact him on 02 9922 5055

Origin Finance is a

Origin Finance is a

Leave a Reply

Want to join the discussion?Feel free to contribute!