Schrodinger’s Cat and the Property Market

By Graeme Salt

I am a simple guy, not much up to philosophy. But today I saw two apparently contradictory headlines which made me reflect on the state of the property market. They were:

- Is this the beginning of the property supercycle?

- Suburbs where property owners are selling at a loss

Believe it or not, both can be true simultaneously – and for the same reasons; its all about supply and demand. Don’t build enough properties and property prices will go up, build too many then there’s an oversupply which drives prices down.

This week these week three pieces of research were produced proving that, since time immemorial, price is driven by supply and demand.

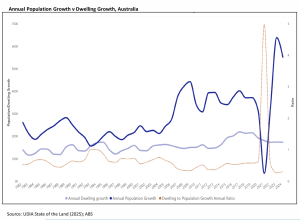

The Urban Development Institute of Australia (UDIA) 2025 State of the Land report shows an alarming 400,000 dwelling supply shortfall.

New dwelling growth has consistently undershot population growth over the last 30 years, creating a serious shortage of national housing supply.

The same day, the Australian Bureau of Statistics (ABS) said a record 200,000 overseas students entered Australia in February – 15 per cent higher than the last monthly record in February 2019, before the pandemic.

There’s now an all-time high of 700,000 overseas students in Australia (many also carrying out valuable jobs) demanding a roof over a head. Couple this with record levels of permanent immigration and demand for housing still outstrips supply – driving up prices. So, unless we build more accommodation, we probably are close to another supercycle.

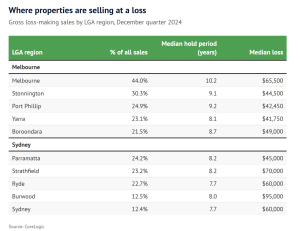

And yet, Corelogic’s Pain and Gain report showed that hundreds of property owners are selling their units at a loss in a handful of high-density neighbourhoods. Of the property owners who sold in the December quarter, 94.8 per cent made a nominal profit (on average $306, 000).

However, there were others who made a loss and they tended to be concentrated in the newer, high-density locations. In many of these instances we have seen a rush of new properties, more than is wanted right now and which can often be of questionable quality.

So, both headlines are probably right – and the lesson is, when it comes to property investments, choose wisely. Across the country, most properties will probably rise over the next decade. But, there will always be underperforming pockets.

If you want to chat about my insights into the property market, feel free to get in touch.

Graeme Salt is an award-winning mortgage broker. For a no-obligations consultation on your home loan needs, please contact him on 02 9922 5055.

Origin Finance is a

Origin Finance is a

Leave a Reply

Want to join the discussion?Feel free to contribute!