Why property is so important to us

By Graeme Salt

Property may well be the biggest investment any of us make. The Australian residential property market stands at $11trn v. Superannuation at $3.9trn and listed stocks at $3.2trn.

This is why the ups-and-downs of the property are a national pastime. As the property market goes up, so does our wealth.

In fact, more than half our wealth (56.3 per cent) is held in housing. So, for many, property is a key investment for their future.

That is why, the current market creates a major opportunity for many who could be just looking to get on the property market or looking to deepen their personal wealth.

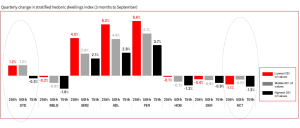

The property market has had a pretty-good run over the past years – Sydney dwelling values are 29.2 per cent higher than pre-Covid levels. But it does seem that the market is running out of steam. This week saw many auction clearance rates well below 50 per cent – a sure sign that things are moving in buyers’ favour.

And, with properties talking longer to sell, it looks like this trend is likely to continue.

But look closer and you will see that there are multiple markets; while Sydney, Canberra and Melbourne may well be struggling, Brisbane, Perth and Adelaide are going gangbusters.

So, why are our two biggest markets and what could case them to change? Traditionally Sydney, Melbourne and Canberra are our most expensive markets and there’s little doubt that potential buyers simply cannot borrow enough to purchase properties.

When banks have to assess someone’s borrowing capacity assuming a rate as high as 6.5 per cent (plus a 3 per cent buffer) – only the super-rich can justify some loans.

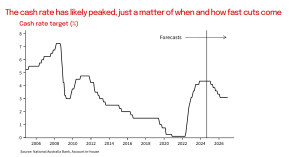

The good news is that rates are due to come down- it’s just that we don’t know when! NAB is predicting rate cuts from February, though it does not recognise it is unsure how many cuts will occur, nor when.

For many, this may create a window of opportunity – rate cuts are likely to spur the market on to other highs (though I do recognise that there are other factors like the return of Donald Trump and the general malaise of the Melbourne economy).

For many, property is the prime source of their wealth and 2025 could be when opportunity beckons for many if they are prepared to get into the market just as rates start to come down.

Graeme Salt is an award-winning mortgage broker. For a no-obligations consultation on your home loan, please contact him on 02 9922 5055.

Origin Finance is a

Origin Finance is a

Spot on with this write-up, I honestly think this site needs far more attention. I’ll probably be returning to read

more, thanks for the information!

Another essential reason to modify to solar technology could be the financial savings it offers. Solar panels can handle generating electricity for businesses, reducing or eliminating the need for traditional types of energy. This will probably result in significant savings on energy bills, particularly in areas with high energy costs. Furthermore, there are many different government incentives and tax credits accessible to companies that adopt solar energy, which makes it a lot more cost-effective and affordable.

The technology behind solar technology is not at all hard, yet highly effective. Solar power panels are made of photovoltaic (PV) cells, which convert sunlight into electricity. This electricity are able to be kept in batteries or fed directly into the electrical grid, with regards to the specific system design. So that you can maximize some great benefits of solar power, it is vital to design a custom system this is certainly tailored to your unique energy needs and requirements. This may make sure that you have just the right components set up, including the appropriate quantity of solar panel systems while the right form of batteries, to maximise your power efficiency and value savings.

Structural issues in pallet racks may cause serious safety risks. Common signs of damage include visible cracks, corrosion, and loose bolts.

Regular inspections are crucial to spot issues before they worsen. If a beam is bent, it should be replaced immediately.

Upright frames may shift due to poor anchoring. Additionally, inspect for corrosion on metallic parts, as this compromises safety.

For complex issues, consult professionals to diagnose and repair the problem.