Kate Burke| Domain| 23 February 2020

https://www.domain.com.au/news/fear-of-missing-out-back-for-sydney-first-home-buyers-as-prices-rise-932720/

First-home buyers are pressing ahead with their dreams of home ownership, rushing to buy in inner and middle-ring suburbs as rapid price growth threatens to push them further out of reach.

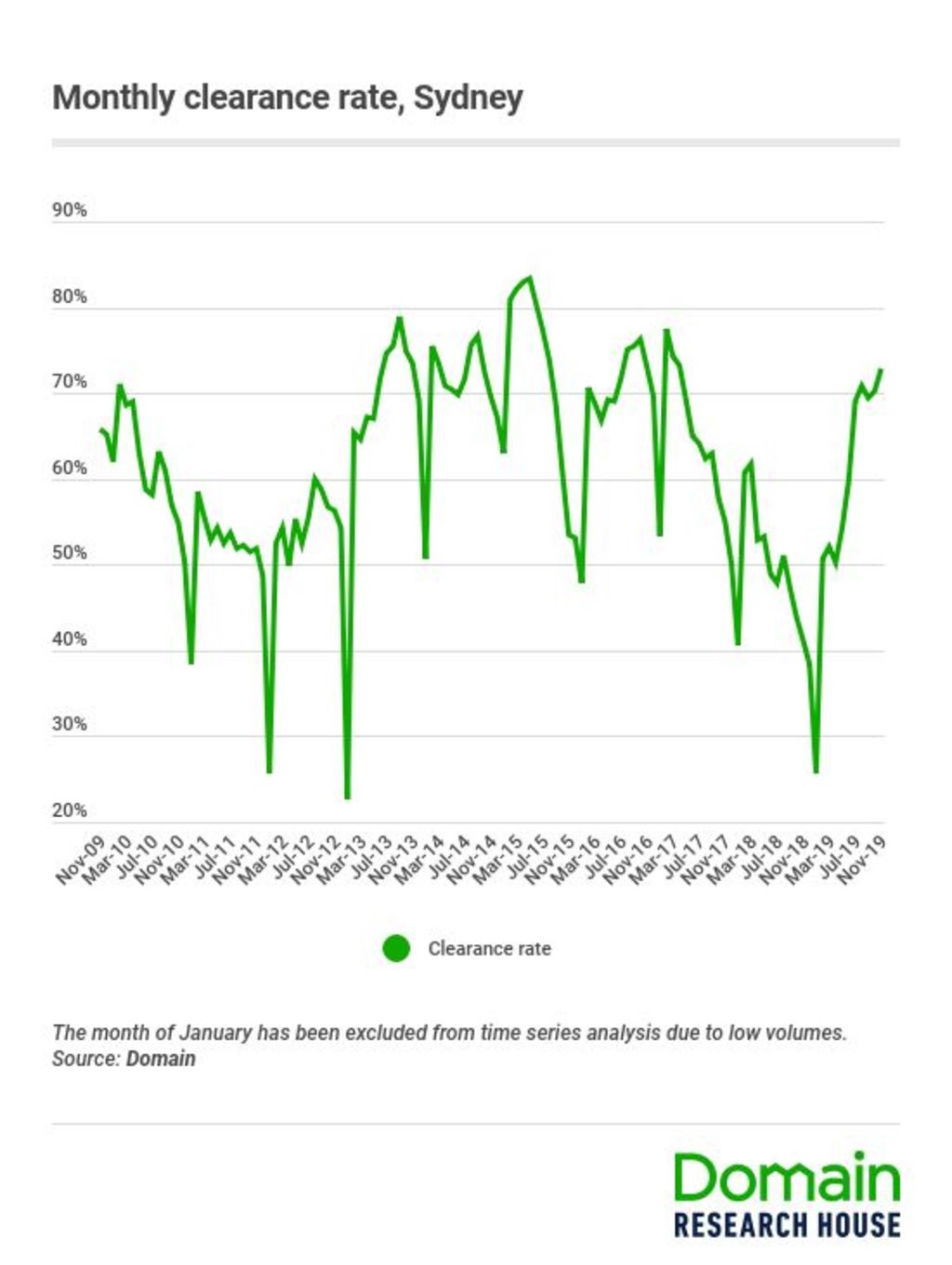

The number of first-home buyers

jumping into the market and how much they are prepared to borrow has soared in

recent months, as Sydney prices continue to rebound.

“There’s definitely a fear of missing out,” said Tom Scarpignato of Belle Property Neutral Bay. “There are people who are feeling like they’ve missed the boat or are going to if they don’t purchase straight away. I don’t know where that’s come from.”

First-home buyer numbers in NSW

are at their highest level since 2012, the latest lending figures from the

Australian Bureau of Statistics show, while the average loan size in December

was up more than 15 per cent year-on-year.

Stamp duty exemptions and

concessions for first-home buyers – for properties up to $650,000 and $850,0000

respectively – were also up more than 25 per cent, state government figures

show.

Sydney first-home buyers have also

been quick to take up the federal First Home Loan Deposit Scheme that was

launched this year, which enables them to purchase with as little as a 5 per

cent deposit.

About 1100 first-home buyers, more

than half of whom are above 30, intend to buy in Sydney – where just over

one-third of homes sell under the $700,000 scheme cap, according to Domain

analysis. Less than 3500 scheme spots remain, with an additional 10,000 to be

released from July.

The lower north shore is one of the hardest areas for first-timers to break

into and is among a dozen regions where 12 per cent or fewer properties sold

under the cap, over the six months to December. Manly and its surrounding

suburbs had the least opportunity – with 1.9 per cent of property sales below

the cap – followed by the Baulkham Hills, Pittwater and Leichhardt regions.

But that’s

not stopping first-home buyers getting into such markets, with 70 stamp

duty exemptions and concessions granted for the lower north shore over the same

period.

The majority, though, have to spend well over the caps, unless

they want an unrenovated one-bedroom unit or studios, Mr Scarpignato says, with first-home

buyers generally spending from $900,000 right up to $1.6 million, which would

secure a two-bedroom apartment or a one-bedroom with parking.

“Even in some of the more

expensive areas there are a decent share of units being sold under the cap, but

of course that proportion is falling quite rapidly,” said Domain economist

Trent Wiltshire.

Almost 30 per cent of apartments sold in inner Sydney were under the cap, as

were about one-third of units in and around Marrickville and Botany and half of

apartments in the Ryde region and Cronulla area.

However

the pool of eligible properties across Sydney would shrink to about 27 per cent

of homes if the current rate of price growth continued, Mr Wiltshire

said. Add further competition from potential interest rate cuts and another

10,000 scheme spots, and first-home buyers are feeling the pressure to get in.

In the Ashfield area, where almost two-thirds of units are selling below the cap, Jackson Cox of Richard Matthews Real Estate is seeing huge first-home buyer demand, particularly for older units.

“I’m seeing more than double the

first-home buyers … than what there was at the end of last year,” he said. “I

think that there’s probably quite a bit of urgency.

“They’re really trying to target

that $650,000 price point to avoid stamp duty, but will go up to $700,000 if

they can,” he said, noting an auction for a two-bedroom unit last week drew

four first-home buyers who pushed the price up to $699,000.

Tom

Armstrong is among more than 6000 first-home buyers who have qualified for the

government’s first-home buyer loan scheme. Photo: Peter Rae

Among them is Tom Armstrong,

who has three months to buy with his scheme spot. While “super small”

apartments in the city were not completely out of reach, he quickly decided to

turn his search to Ashfield and Croydon in the inner west, then further afield

to Parramatta to get a two-bedroom apartment.

“It’s been pretty full-on, a lot

of [the properties] have line-ups at the door, especially the inner west ones,”

the 30-year-old said. “I definitely want to get in as soon as possible while

there is stuff I like, three months isn’t that long if you’re too picky.”

While most scheme spots nationally

were being used to buy houses, Mr Armstrong said that was not viable in Sydney

unless you moved really far out.

Mr Wiltshire said the government

would likely need to revise price caps next year if it continued with the

scheme, but noted this might only put further upward pressure on prices.

“Yes, it will help those people

that get to use the scheme, get into the market earlier … but overall it’s not

really helping housing affordability because it’s pushing prices up.”

Aris Dendrinos of Richardson & Wrench Hurlstone Park said two-bedroom apartments in the Marrickville area had pushed over the cap in recent months, leaving many first-home buyers disappointed.

“It’s very challenging now to be

getting a two-bedroom apartment for that price, and that’s pretty confronting.

I helped buyers get similar apartments for $610,000 six months ago,” he said.

Mr Dendrinos said he was

increasingly seeing first-home buyers compromise on the size of the apartment

they wanted, or looking to borrow more, because they didn’t want to change

their location.

As the coronavirus pandemic hit last year and budgets threatened to break, CBA sent a letter to mortgage holders saying their repayments would be automatically cut to the minimum.

As the coronavirus pandemic hit last year and budgets threatened to break, CBA sent a letter to mortgage holders saying their repayments would be automatically cut to the minimum.

One small lender reckons you can switch to them quickly – and at much lower rates thanks to new technology.

One small lender reckons you can switch to them quickly – and at much lower rates thanks to new technology.

Origin Finance is a

Origin Finance is a